Rents Don’t Always Rise: What HUD’s New Data Tells Us About Rental Inflation in NZ

For years, investors have operated on a baked-in assumption: that rent goes up. Maybe not every month, but certainly every year. And in a high-inflation world? Even better. Or so we thought.

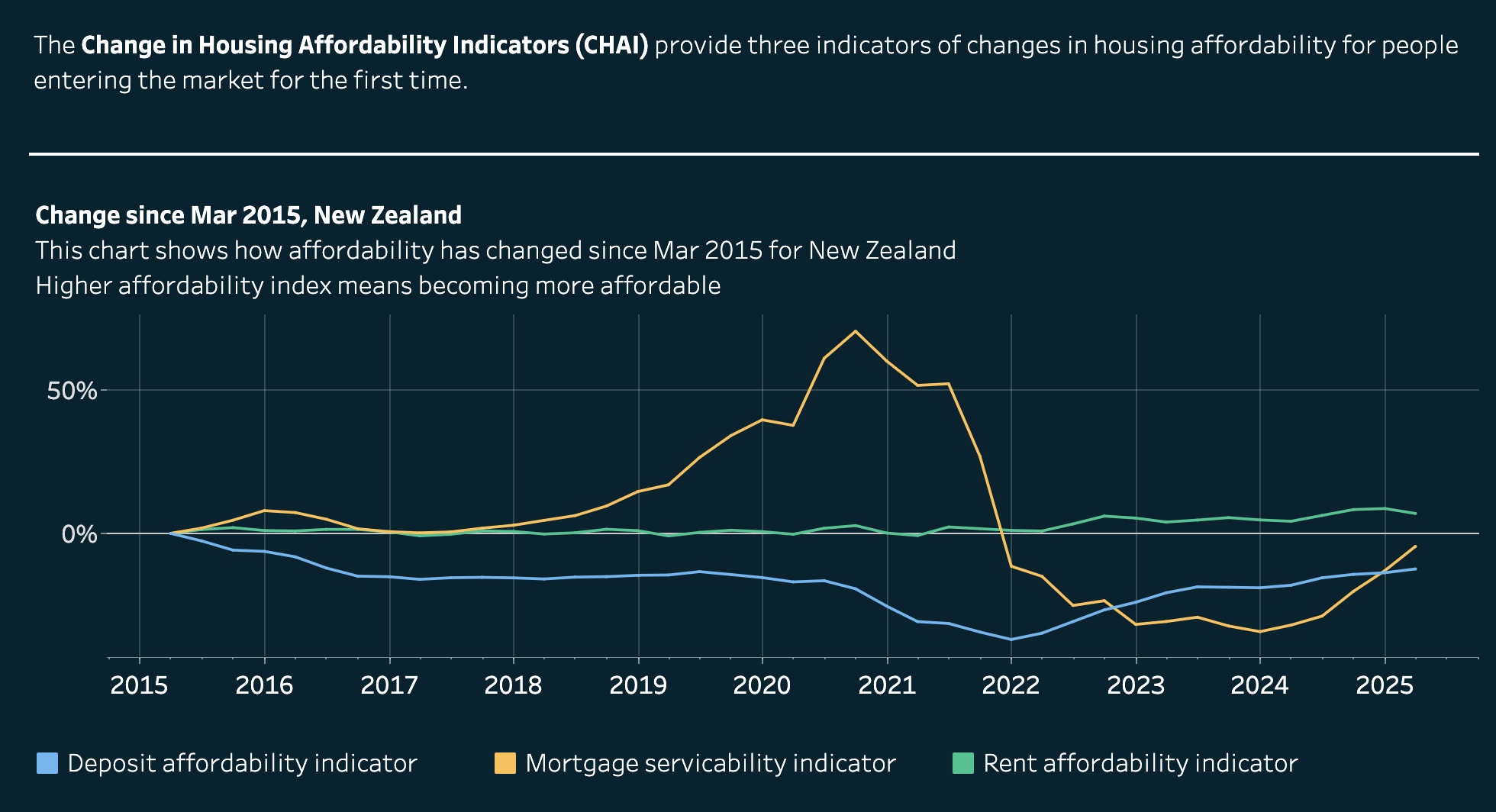

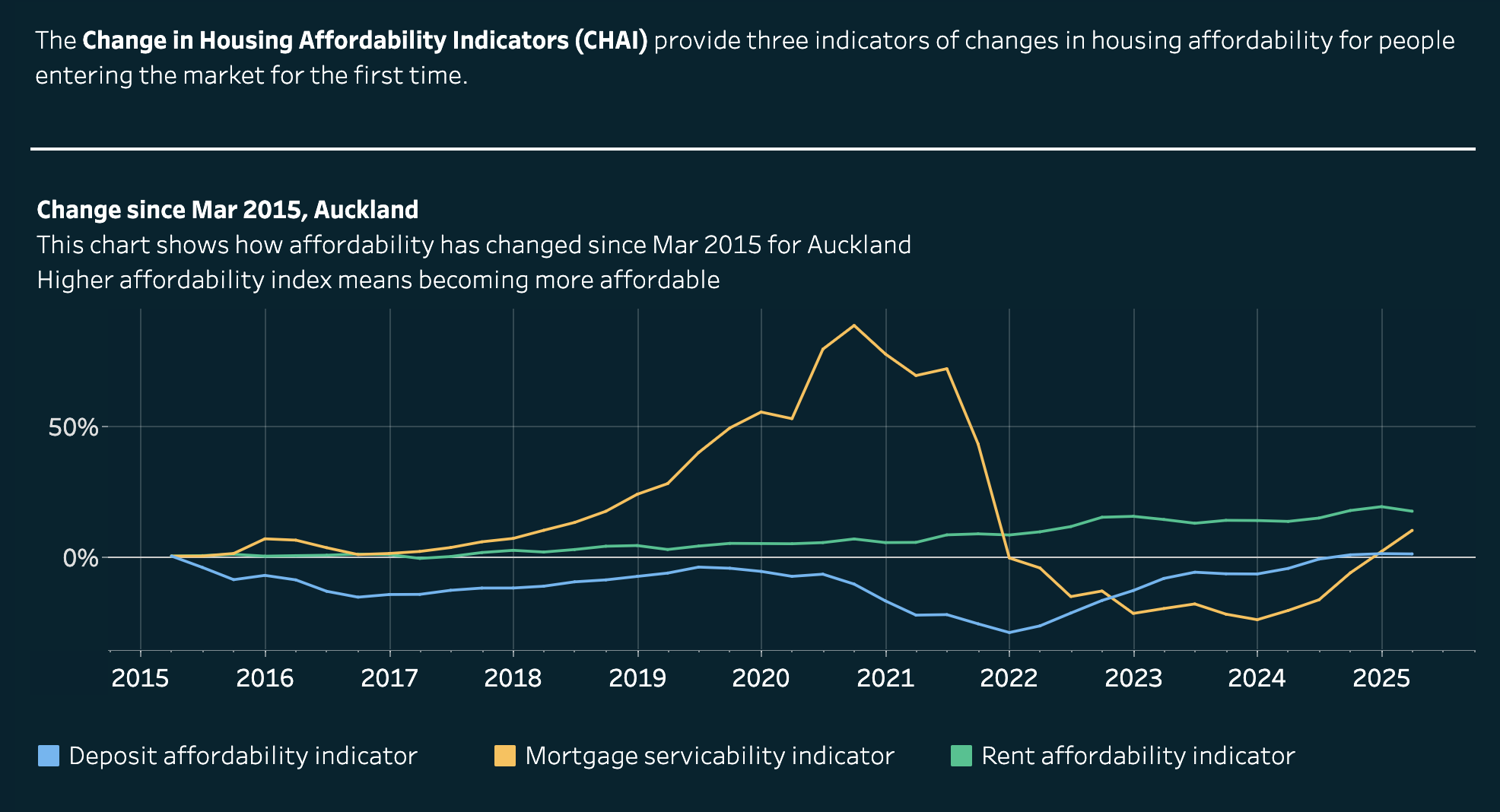

The latest data from the Ministry of Housing and Urban Development (HUD) flips that assumption on its head. According to HUD’s newly released rental inflation index, an adapted monthly version of the quarterly measure used in its Changes in Housing Affordability Indicators (CHAI), New Zealand’s rental market has entered negative territory.

In April 2025, annual rental inflation fell by 0.7% nationwide, with Auckland (-2.4%) and Wellington (-3.1%) leading the drop. Canterbury bucked the trend slightly, still showing growth (+2.1%), but that growth has slowed. The gear is shifting and investors need to pay attention.

📉 What’s Causing the Dip?

HUD points to three key factors driving this cooling trend:

- A surge in completed builds adding rental supply

- Slower net migration, reducing immediate demand

- A high number of rental listings, giving tenants more choice and bargaining power

But dig a little deeper, and the signal gets sharper. This isn’t just a supply story. It’s a wage story.

In the year to March 2025, CHAI data shows rental affordability for new tenancies improved by nearly 3%, driven largely by wage growth outpacing rents. Put simply: tenants are getting more breathing room, not because rents are crashing, but because wages are finally rising faster than inflation.

“If you are still autopiloting your rent,” says APIA General Manager Sarina Gibbon, “you’ll get lapped by other investors and dropped by your tenants.”

🤔 So What Does This Mean for Investors?

If you’re expecting rents to keep climbing by default, it’s time to recalibrate. The data spells out a clear message:

Rental growth is not a given, it’s earned. And in this market, the investor edge comes from agility, not assumptions.

That means:

- Relying on wage growth trends, not just CPI, to guide your rent reviews

- Prioritising tenant retention over pushing market rates

- Investing in value-add improvements that justify higher rent without losing tenants

Smart investors will stop chasing higher rent and start chasing higher occupancy. Your best-performing property in 2025 might not be the one with the highest rent – it’ll be the one that’s always tenanted, has low turnover, and keeps quality tenants in place. Stability now trumps short-term gains.

“We’ve got slowing demand, rising supply, and real wage growth all colliding,” says Sarina. “The smart play isn’t squeezing tenants harder; it’s running a tighter and smarter rental business.”

🔍 Stay Sharp. Stay Ahead.

HUD’s stand-in measure, based on rental bond data, offers a credible lens into what’s happening today. For investors, it’s not just about tracking rent – it’s about understanding the forces behind it: wages, migration, and supply.

Our events help you figure out the “so what.” Whether it’s diving into affordability trends, rethinking your rent strategy, or understanding how policy shifts affect your bottom line, we bring together thought leaders, everyday investors, and decision-makers to keep you in the know.

Add Comment