Because good advice never gets old and the good ol’ Michael Yardney is nothing if not quotable:

… [i]n their haste to hitch on to this new property boom, many beginning investors have chosen to devalue “credibility” in favour of “believability.”

Let me explain the difference. Credibility requires education, track record and proof of value – all things produced by an investment in time. On the other hand, believability requires only the ability to create belief – and that’s so much easier to do today with a fancy website and a glossy brochure.

I’ve recently come across a new firm that is “pretending” they are Australia’s largest buyers agent. Despite having a small team they “pretend” they have offices in most Australian capital cities and New Zealand. I’m sure their glossy brochure and fancy website impresses lost of potential clients.

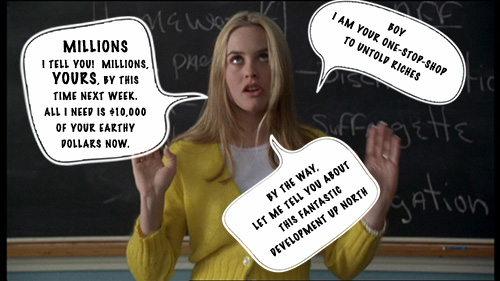

Then there are the seminars that make outrageous promises. Come to my course and I’ll teach you how to invest like the pros and buy property with options – you know what I mean… put down $1,000 and control millions of dollars worth of property. Or the ones that say buy my DVD course and become a property developer over the weekend. You know… build 4 units, sell 3 and keep one free of debt.

All this sounds too good to be true doesn’t it? OF COURSE IT DOES!

Now that the property market is recovering and inching towards a boom, all the pundits are out!

The APIA Elves are getting more than usual enquiries about various property coaches, seminar providers, authors, self-proclaimed experts and what-have-you’s. Running an independent organisation means that the Elves do not officially endorse any businesses or “professionals” (industry-recognised or otherwise) nor do we engage in peer reviews of other seminar providers.

However, we are keenly aware that a rising market can sometimes disguise the incompetency of investors, some of whom are ‘advised’ by incompetent advisers. That is all fine and dandy when times are good, but cracks start appearing when the market gets to the inevitable downturn.

Some of these commentators and ‘advisers’ are completely legit. Typically they have been investing for many years and had amassed incredible knowledge by going through the various stages of one or more property cycle(s). Sadly, there are others better described as ‘property pretenders’ who pretend to be experts. Don’t get us wrong, every man has got to do his thing to survive. We get it and we don’t want to rain on anyone’s parade. But the Elves run APIA with the mantra that Knowledge is Power and when that knowledge is corrupt/compromised, so is the investor’s power to control her financial future.

P. T. Barnum said, “There’s a Sucker Born Every Minute.” – Don’t Let That Be You

So to help you navigate your way through a sea of property pundits who may or may not the genie that brings you untold wealth –

1. The Golden Property Formula

Safe Property & Finance Strategy + Right Property + Right Location + Right Price + Good Tenants + A Sprinkling Of Patience To Hold the Property Long Term = Investment Success. No matter where you are at the property cycle, this IS the formula.

2. Property Will Not Get Your Rich Overnight

Any scheme that promises to get you rich quickly will also come with a high risk of getting you poor very quickly.

3. There Ain’t No Such Thing As A Free Lunch

Be wary of free advice. Someone somewhere is paying for that advice, even if it is not you. Have you noticed that a lot of free seminars are actually sales presentations for developers or property courses? Sometimes it pays to make necessary enquiries to find out who is footing the cost of the free advice. (By the way, we might as well say this now – when the APIA Elves invite you to a meeting free of charge, we are giving you exposure to good industry information as well as trying to sell you an APIA membership which conveniently you can get at an incredibly small price by clicking here.)

4. Buzz Words “Independent” and “Unbiased”

A team of independent and unbiased professionals who you know and trust will help you along your investment journey. What do they have over the others? Integrity with their advice.

5. Be Aware of the Financial Advisers Act

Financial advisers are now regulated by the Financial Advisers Act. (As an aside, something for newbie investors to mull over – why does Parliament feel the need to intervene and regulate industry ‘advisers’?) Familarise yourself with the ambit of the act, under the differences between a Registered Financial Adviser and a Authorised Financial Adviser, find out the exact role of the adviser you are listening to and whether you are being given financial advise at all or if the person is speaking to you in broader terms.

6. Empower Yourself To Be Financially Fluent

At the end of the day, the person in the best position to make the best decisions for you is yourself. Become a specialist in the market you invest in and make informed and intelligent decision for your financial future.

Have you any other tips to share to help your fellow investors to getting good quality investment advice? Be kind and share by leaving a comment below.

Add Comment