Vendors appear to be buckling in quite a few parts of Auckland

It’s a stylised fact that during property market upswings, the growth in values tends to be fairly synchronised and widespread. Certainly, if you drill down to median property values at a suburb level ‘all boats were floated’ across NZ over 2020-21 by the rising tide of favourable interest rates and mortgage finance that was relatively easy to secure (e.g. due to the temporary removal of the loan to value ratio rules).

However, that upswing has pretty quickly given way to an abrupt slowdown phase, as higher mortgage rates bite harder (as borrowers on fixed rates roll onto new terms) and as the full effects of lending rule changes at the end of 2021 take hold. In particular, if you keep in mind that the LVR rules were tightened for owner-occupiers on 1st November and that the CCCFA changes kicked in on 1st December, it’s striking that within that 3-4 month period we’ve really seen a quick halt to property value growth.

To be fair, some areas/property types are still seeing continued growth, as demand remains strong – there’s a suggestion that ‘solid, family homes’ are in that category. But elsewhere, there’s either a standoff between buyers and sellers with a price hard to settle on (and properties are sitting unsold for longer), or there are clear signs that vendors have become more pessimistic and are now willing to accept lower prices.

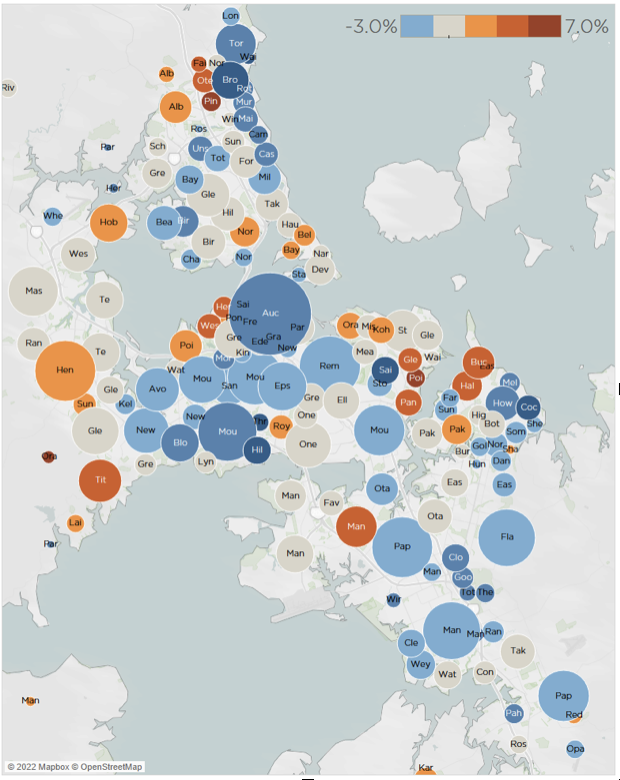

Many parts of Auckland are included in this group where median property values have actually fallen outright over the past three months – see the map below (with the number of properties in each suburb represented by the size of the circle, and the recent change in values represented by the colour – blue being falls). An interactive version of the map, which covers median values and % change over the past three months is available at: www.corelogic.co.nz/mapping-market.

Chart: Three month % change in median property values by Auckland suburb

Indeed, across roughly 200 suburbs that we cover, only about 60 have seen an increase in median values over December to February of 1% or more, while more than 90 have seen a drop of at least 1%. Several have seen falls of more than 4%, including Wiri, Campbells Bay, Mount Roskill, Three Kings, and Saint Johns. In these areas, the so-called fear of missing out (FOMO) has probably now given way to fear of over-paying (FOOP) – with vendors buckling to the likely ‘cheeky’ offers being put in by buyers.

Table: Top and bottom 10 Auckland suburbs – % change median values in past three months

It’s also important to note that these clearer signs of price fall at the suburb level aren’t just confined to Auckland either. There is also evidence of weakness in Hamilton, Napier/Hastings, Kapiti Coast, Wellington (especially Lower Hutt), Dunedin, and Queenstown. On the flipside, Tauranga, Rotorua, New Plymouth, and Christchurch (as examples) still look a bit stronger.

Taking a step back, is this is a surprise, and what does it all mean? First, it’s not that surprising – in the early stages of a slowdown, ‘patchiness’ is often seen, as buyers and sellers react differently depending on location, local economy etc. Second, from an investor’s perspective, it could clearly mean some buying opportunities. Obviously, there’s the hurdle of a 40% deposit to be climbed and the debt will come with a higher mortgage rate too – not to mention no interest deductibility, unless it’s a new build. Even so, in this market, there are likely to be some bargains on offer.

However, it’s conceivable that the buying window may not last forever. After all, we don’t foresee major, widespread drops in property values, provided that unemployment stays low. Mortgage serviceability test rates are also a buffer for the market, as is the speculative possibility that if a more serious downturn really got going, the Reserve Bank would have the power (and track record) to loosen LVRs, and potentially also kick debt to income ratio caps into the long grass.

Kelvin Davidson

Kelvin Davidson is the Chief Economist of CoreLogic New Zealand.

Add Comment