You’ve heard the line: Auckland is growing. Guess what? Not all growth delivers returns.

As investors, we’ve been trained to treat population growth as the rising tide that floats all boats. But Auckland’s latest economic snapshot paints a different picture. A more nuanced, sharper one. And if you’re investing off assumptions from five years ago, just know that it is laziness, not optimism.

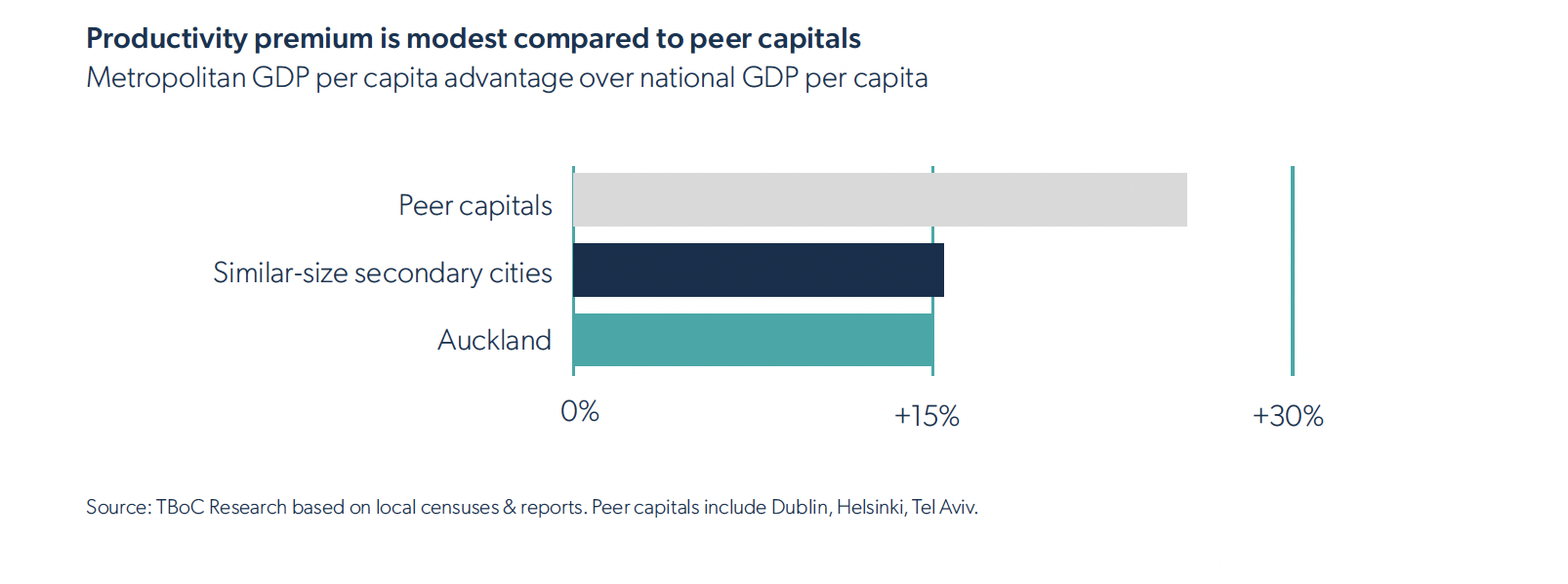

Auckland is stuck in a low-productivity loop. The city is getting bigger but not richer. And if you’re counting on capital gains to simply roll in because your property has an Auckland postcode, it’s time to go back to the drawing board.

Auckland: Big, But Underpowered

Let’s start with the numbers.

Source: State of the City 2025 Report

Despite being home to a third of the country’s population, Auckland’s GDP per capita is 15 to 20 percent lower than peer cities like San Diego, Vancouver, and Brisbane. That should be a massive wake-up call.

Productivity growth in Auckland has averaged 1.0 percent annually, compared to 1.4 percent in peer cities. That difference compounds fast, especially when you’re holding leveraged assets.

“We’ve spent too long mistaking size for strength,” says Sarina Gibbon, GM of APIA. “Having the most people doesn’t mean Auckland creates the most value. That gap will show up in your balance sheet eventually.”

The New Game Is Returns You Engineer

The days of passive capital gains are fading. In an environment where the macro tailwinds are weakening, your property’s value growth has to be earned, not assumed.

Forget the dream of buy, hold, and hope. The winners in this next cycle are doing three things:

- Upping yield through smart upgrades: not gold-plating, but practical reconfigurations

- Unlocking hidden value: by improving floor plans, adding minor dwellings, or legalising existing structures

- Sweating the small stuff: because vacancy days, deferred maintenance, and poor layouts eat into profit when prices are flat

“You’ve got to actively create the upside now,” says Sarina. “The market isn’t going to gift it to you.”

Comparative Advantage Is Narrowing

Once upon a time, Auckland enjoyed a clear lead over regional centres like Tauranga or Hamilton. That lead is now down to just 3 to 5 percent in productivity terms. That margin is shrinking, and so is the cushion for investors.

This matters. Because when you invest in Auckland today, you’re competing not just with local buyers but with smarter regional alternatives. The argument for Auckland needs to be asset-specific, not city-generic.

What Investors Need to Do Now

1. Get selective

Invest where productivity is rising. That means the city centre and high-density fringe nodes, places that attract jobs, students, researchers, and working professionals. Use reliable, up-to-date tools like this Infometrics breakdown of Auckland city’s GDP contribution to guide your due diligence.

2. Demand more from your property

If your investment doesn’t cashflow or can’t be improved, move on. In a low-growth city, passive equity is a myth. Auckland is still investable, but only if you treat each asset like a business unit, not a nest egg.

3. Think in terms of productivity per square metre

Does your property support the kind of living, working, or mixed use that the city’s economic engine needs? If not, it’s going to feel more like ballast than a vehicle for growth.

“Don’t fall for the comfort of averages,” says Sarina. “Invest where value is actually being created. Better yet, be bold and go create those values yourself.”

This is the first of our three-part blog series on insights and reflection from the 2025 State of the City report published by the Committee for Auckland.

Add Comment