Recently, CoreLogic has developed a new dataset/product, called Market Trends, which contains granular detail down to suburb level, also split by property type and bedroom count. Users can easily slice and dice the figures depending on their area of interest, so it’s pretty useful for investors looking at their next purchase or benchmarking the performance of their existing property portfolio.

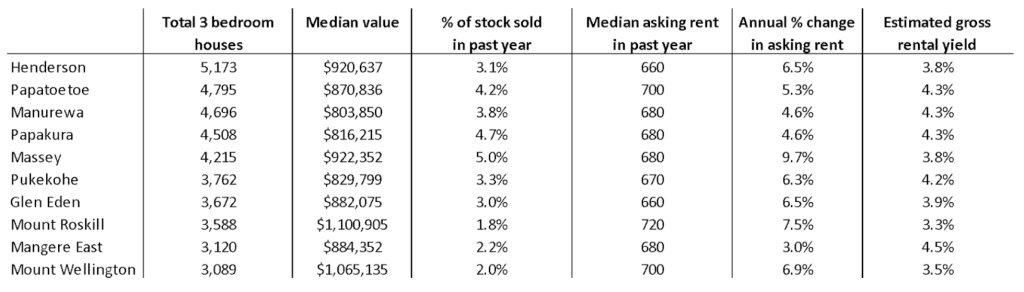

What can we currently learn about the state of rental property returns across some key parts of Auckland? Let’s use three-bedroom houses for this example, given this is a standard type of rental property, and we’ll focus on the 10 areas of Auckland with the largest counts of this dwelling type.

Some key points to note:

- There’s obviously quite a wide range of values for these suburbs. Three-bedroom houses can still be secured for less than $900,000 (at least based on our estimate of current values) in areas such as Papatoetoe, Manurewa, Papakura, Pukekohe, and Glen Eden.

- That said, some areas are more ‘tightly held’ than others, possibly making entry a little harder. For example, in the past year, only 3% or less of three-bedroom stock has changed hands in Mount Roskill, Mount Wellington, Mangere East, and Glen Eden. Papatoetoe and Papakura have been more liquid markets, with 4-5% of three-bed houses being traded.

- Across these large markets for three-bedroom houses, rents are fairly tightly bunched at $680-$720 per week, although Henderson, Glen Eden, and Pukekohe are a little lower.

- Rental growth itself has been fairly solid, as you’d expect in a market where demand is high (on the back of net migration flows), but supply is tightening. Growth of 5-10% in the past year has been pretty common.

- Meanwhile, gross yields differ a bit across these suburbs, but three-bedroom houses deliver at least 4% in Papatoetoe, Manurewa, Papakura, Pukekohe, and Mangere East.

Now, we are not investment advisers, so these are just general observations. And, of course, nobody actually buys an ‘all-of-suburb’ property; they do individual deals for individual dwellings. Nevertheless, these high-level indicators illustrate some of the things that would-be investors are looking at all the time, and this particular dataset/analysis suggests that there could be some merit in three-bedroom houses in Papatoetoe and Papakura, as examples. Of course, a different analysis, perhaps of two-bedroom townhouses or new-builds, might reveal different insights altogether.

Taking a step back, it will arguably be another fairly challenging year for property investors, regardless of location or dwelling type. After all, with mortgage rates probably set to hover at 7% for a while yet, getting the cashflow to stack up on typical rental property purchases remains tricky.

Kelvin Davidson

Kelvin Davidson is the Chief Economist of CoreLogic New Zealand.

Add Comment