Our Buyer Classification figures are always fascinating to track, showing how market shares for each different buyer group are changing through time. But currently, they’re perhaps even more interesting than usual, with a ‘debt vs equity’ theme really starting to show through.

Indeed, across the country as a whole, the market share for mortgaged investors (multiple property owners/MPOs) in Q1 2022 was flat at around 23%, the same level for the past 6-9 months, and well down on the peak of 29% in Q1 last year (prior to the 40% deposit requirement and phased removal of interest deductibility). First home buyers are struggling too, also with just 23% of purchases in Q1 (versus 26% three months ago).

By contrast, those with a bit more of an equity base behind them – i.e. cash investors and relocating owner-occupiers – have seen increased market shares (albeit in a quieter overall market in terms of the raw numbers of deals). At 13%, the cash investor figure was at a two-year high in Q1, while the figure for movers was 29%, the highest since the middle of 2016.

Of course, a debt-vs-equity theme is no major surprise in this market, where interest rates have risen and mortgage finance is harder to secure anyway (due to various lending rules).

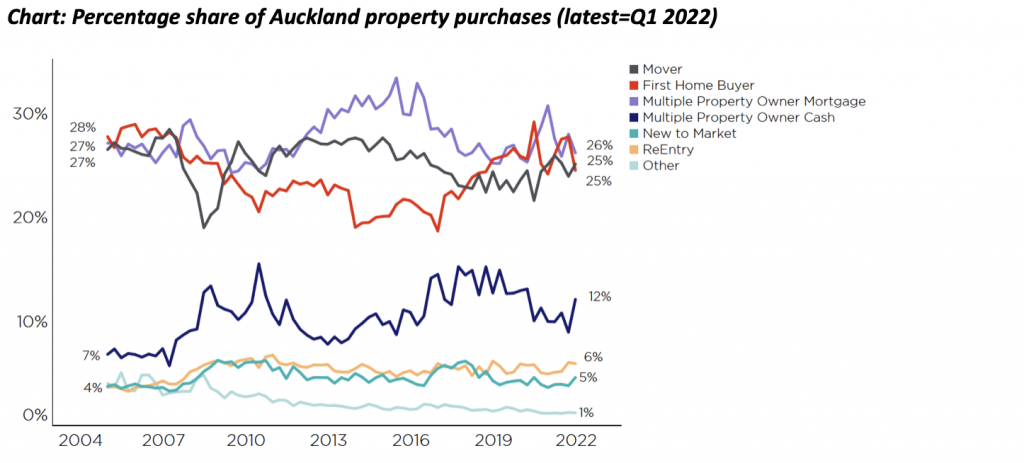

What about in Auckland? As the chart shows, these same trends broadly prevail – e.g. cash investors have perked up a bit, movers are creeping higher, and first home buyers have dipped a little. However, the percentages themselves are different, and that’s certainly the case for mortgaged investors. Yes, that share has dropped from where it was a year ago (31%), but at 26% in Q1 2022 it remains higher than the national figure.

In other words, mortgaged investors looking to make more purchases certainly haven’t abandoned Auckland altogether (with new-build properties still seeming to be popular with smaller and/or new entrants), and nor are we seeing any real evidence that landlords are looking to sell existing holdings in greater numbers either.

In more detail, Waitakere is certainly still a ‘first home buyer’s’ market, while Franklin and Rodney are dominated by movers or relocating owner-occupiers. Auckland City tends to be an investment-driven area, although movers and first home buyers are a presence in certain suburbs. North Shore has also seen a continued presence for mortgaged investors, but perhaps the most interesting areas for this group are Manukau and Papakura, where the market share is still greater than 30%. Obviously, in those parts of Auckland, some investors are still seeing value.

What about by suburb/property type? Clearly, at this level of granularity, care needs to be taken when thinking about sample size etc. But if we hone in on three-bedroom houses, there are now only three areas of Auckland that have yields equal to or above a fairly standard national benchmark (2.6%) – these are Mt Roskill/Wesley (2.6%), Avondale (2.7%), and Otahuhu (2.9%).

In other words, it’ll obviously be getting harder to make the sums stack up in many parts of Auckland when it comes to buying an existing property and renting it out as it stands – especially with gross yields low, mortgage rates rising, and capital gains fading (or even turning negative). Of course, some will be using the Unitary Plan to their advantage, and buying with the intention of redevelopment into townhouses or similar (provided that they can actually find a builder to do the job).

Either way, the key point, for now, is that mortgaged investors are still active in many parts of Auckland – albeit the opportunities will be harder to find.

Kelvin Davidson

Kelvin Davidson is the Chief Economist of CoreLogic New Zealand.

Add Comment