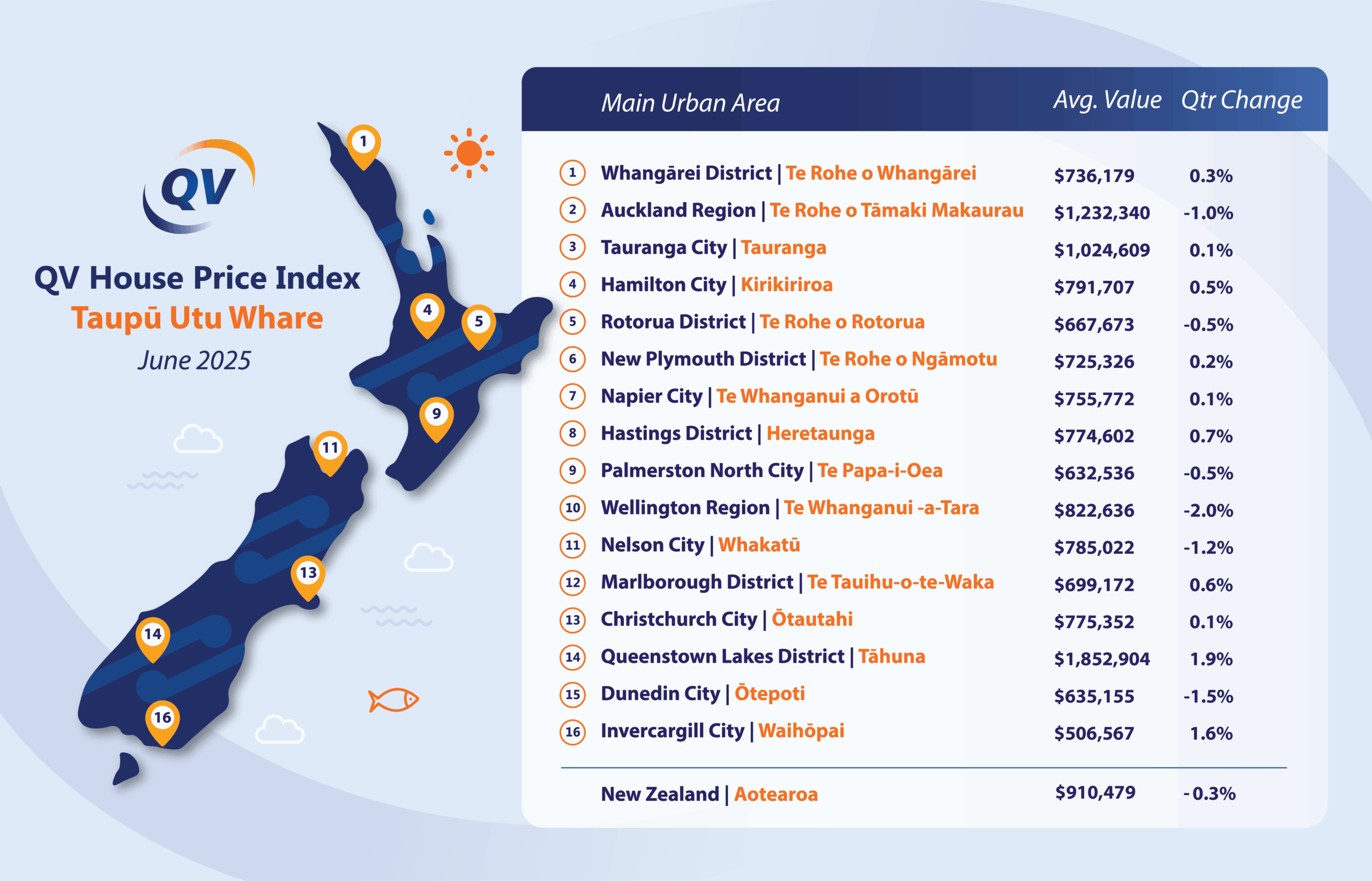

Today’s QV House Price Index for June 2025 was released, showing a 0.3 percent national dip. The average Kiwi home now sits at $910,479, down 0.6 percent year-on-year and well below the late-2021 peak. Smart investors and sellers will spot pockets of opportunity and clear signals on where to focus.

Is Now the Time to Add to Your Portfolio?

Values are easing in many regions. Wellington is down 2.3 percent, Nelson–Tasman down 2.3 percent and Dunedin off 1.5 percent. Cash-flow buyers can pick up yield-friendly stock at softer prices. Far North, Hawke’s Bay and Queenstown still shine. You don’t need a million-dollar budget. Smaller centres like Buller (+6.2 percent) and Gore (+8.8 percent) defy the national trend.

OCR & Financing Outlook

Recent OCR cuts to 3.25 percent have eased borrowing capacity. Economists expect the Reserve Bank to hold rates at this Thursday’s review. Further cuts to 2.75–3.00 percent by year-end remain possible. Financing is kinder today and may get easier.

Vendor Strategies, When to Sell, When to Hold

- Targeted upgrades – fresh paint, tidy landscaping and neutral flooring cut days on market and boost appeal

- Portfolio rebalancing – sell under-performers in soft areas to fund buys in stronger pockets such as Queenstown or Napier

- Staggered listings – phase stock onto the market over weeks to avoid competing with yourself

Key Headwinds to Navigate

- Financing rules – LVR and DTI limits still constrain highly leveraged investors

- Market uncertainty – softening jobs data and global tensions could delay recovery

- Regional variation – what works in Gore may not work in Tauranga

Who Can Help You Win?

No one does it alone. Tap into APIA’s network:

- Mortgage brokers to secure today’s rates

- Property managers to find low-vacancy, high-yield suburbs

- Investment strategists for portfolio modelling under different rate scenarios

- Renovators and trade partners to cost out high-impact capex

- Local real estate agents to uncover off-market gems

Real Investors over Macro Data

The QV map is useful, but it’s data from a distance. To understand risk, reward and the cash-flow grind, you need stories from investors on the ground.

ICYMI: Nick Tuffley on ASB’s Outlook

Economist Nick Tuffley joined us for an APIA keynote to outline ASB’s view of a slow, single-digit recovery. Watch below:

The full video When Will Properties Come Up Trump is on APIA TV.

Don’t Miss The Prized Child & The Black Sheep

Join us Tuesday, 15 July 2025 for a no-fluff panel with Sarah Wilson and Dean Wilson (no relation). They’ll share prized purchases, black-sheep deals and lessons every investor needs.

When & Where

Date: 15 July 2025

Doors open 6:30 pm, panel 7:00 pm–9:15 pm

Jubilee Hall, Parnell Jubilee Building

Reserve your seat now (Free for APIA members; a small fee for non-members.)

Don’t rely on maps and macro data alone. Talk to investors who’ve been there and know what really works.

Add Comment